Web-based automated solution for community banks to process

PPP Forgiveness Applications

How it works

Simple import of existing applications

Automated SBA Form 3508

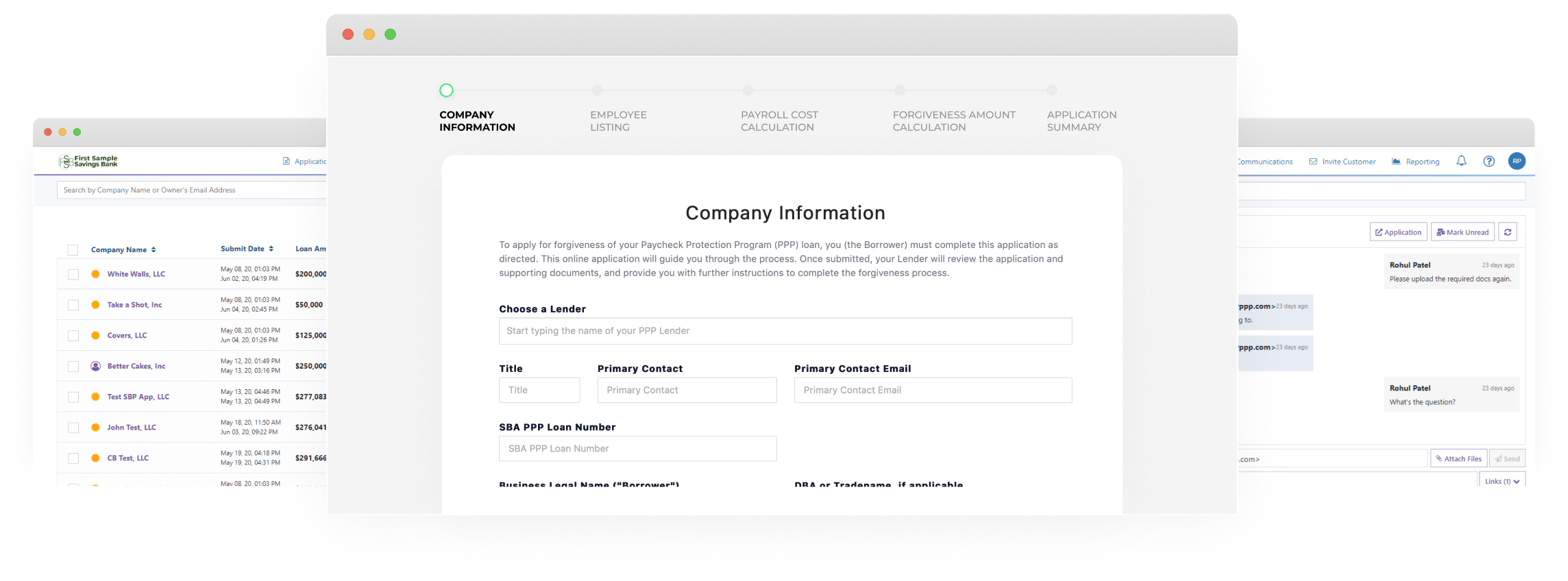

Seven to eight weeks after disbursement, each borrower will be emailed a unique URL to access a web-based forgiveness application (www.applyforppp.com/yourbankname/unique-code). The SBA’s Form 3508 is fully automated with dynamic smart-fields for your borrowers convenience.

Borrowers can securely upload (via drag/drop) all required proof of documentation directly next to the respective questions to ensure accuracy and avoid confusion. The PPP Schedule A Worksheet has been simplified to assist borrowers and contains automated calculations and ability to add unlimited employees and owners.

Auto-filled e-sign documents

Streamlined “good-faith review”

Auto-filled e-sign documents

An individualized email communication system between the lender and borrower will allow for easy back and forth communication. Additionally, bank users can create and save email templates that can be sent to borrowers based on certain smart triggers.

Borrower’s can reply directly to the emails sent from the lender portal, which will free up lender resources and streamline the process by keeping all borrower communications in one area. Audit logs and user trails are downloadable in batch files to comply with lender’s records retention requirements.

A flat fee per forgiveness application will be charged

based on the volume of applications processed.

About us

Reliant Business Valuation, the leading tech-enabled business valuation and equipment appraisal firm founded in 2010 that serves over 150 SBA lenders around the nation, has invested heavily in digital technology and automation over the past few years. This allowed us to swiftly pivot part of our technology to simplify and automate the PPP loan process, enabling us to further assist our SBA lender clients during this constantly evolving program. Through a web-based digital platform, borrowers fill out their PPP (loan or forgiveness) web-application and securely upload of supporting documentation. PPP lenders have access to a secure portal, which organizes all of their borrowers' applications, facilitates a good-faith review, and automates the document creation and e-signature process.

Through this difficult time, Reliant Business Valuation continues its mission to build a premier company to guide entrepreneurs who drive our economy.