PPP Origination and Forgiveness Automation For Community Banks

Forgiveness Simplified

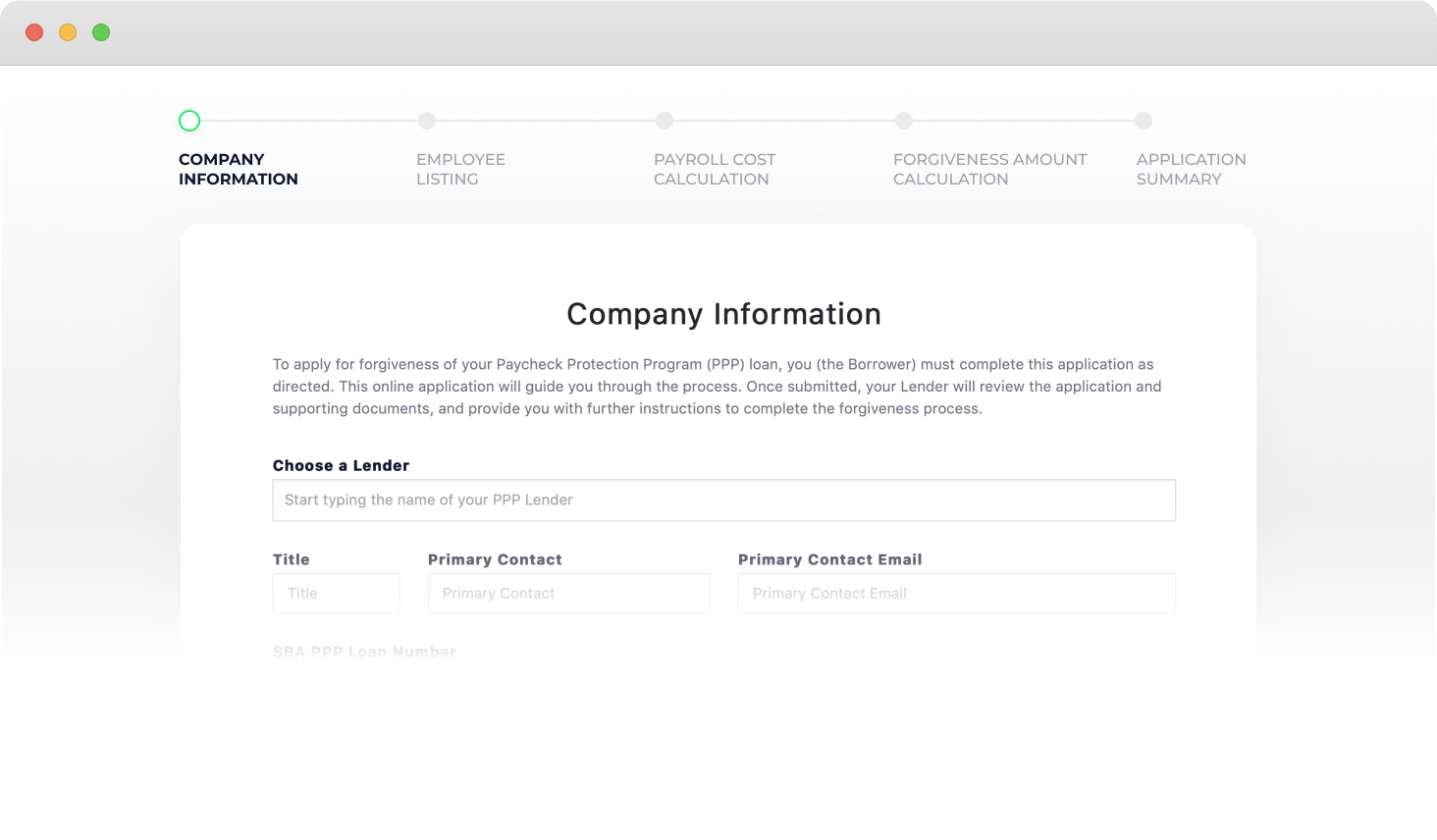

Example of completed forgiveness application

Is your bank ready to

Automate the entire PPP process?

Bank Level Security

Our portal provides features to help our clients comply with data security laws as well as ADA compliance laws.

We respect each borrower's privacy. Please view our Privacy Policy for more information on what information we store - just know, we will never share or sell your information.

About us

Reliant Business Valuation, the leading tech-enabled business valuation and equipment appraisal firm founded in 2010 that serves over 150 SBA lenders around the nation, has invested heavily in digital technology and automation over the past few years. This allowed us to swiftly pivot part of our technology to simplify and automate the PPP loan process, enabling us to further assist our SBA lender clients during this constantly evolving program. Through a web-based digital platform, borrowers fill out their PPP (loan or forgiveness) web-application and securely upload of supporting documentation. PPP lenders have access to a secure portal, which organizes all of their borrowers' applications, facilitates a good-faith review, and automates the document creation and e-signature process.

Through this difficult time, Reliant Business Valuation continues its mission to build a premier company to guide entrepreneurs who drive our economy.